PayProp

Looking for a client account? Five steps to better lettings banking

19 April 2024 4521 Views

You don’t have to simply accept things as they are when it comes to managing your client accounts. If your bank won’t keep your account open, or you find yourself buried in manual tasks and inefficiencies or relying on third-parties, it's time to explore alternative solutions.

Here are five steps to reclaim – and improve – your client accounting:

1. Ask other agents

In an industry as unpredictable and dynamic as lettings, agents need to stick together.

Given the ongoing risk of some financial institutions closing thousands of agency accounts, it’s vital to know which banks or other providers give agencies reliable and high-quality client accounting services. Reach out to your fellow agents for their first-hand experiences to identify potential partners who can effectively meet your agency's needs.

2. Talk to industry associations

Beyond your immediate network, industry associations including Propertymark and Safeagent are excellent resources for impartial, bespoke advice on compliant banking options.

These organisations maintain trusted relationships with various banks and other suppliers, such as PayProp, and their industry experts can guide you towards the solution that best fits your agency’s unique requirements.

3. Keep control

You built your business from the ground up, so why would you hand over the keys to your client accounts to someone else – whether they’re a colleague or accountant with full access to your agency client account, or a third party?

With PayProp, you’re the boss. Through its partnership with NatWest, PayProp empowers letting agents with a supercharged property-specific client accounting environment that is fully compliant with CMP regulations and protected by the Financial Service Compensation Scheme (FSCS).

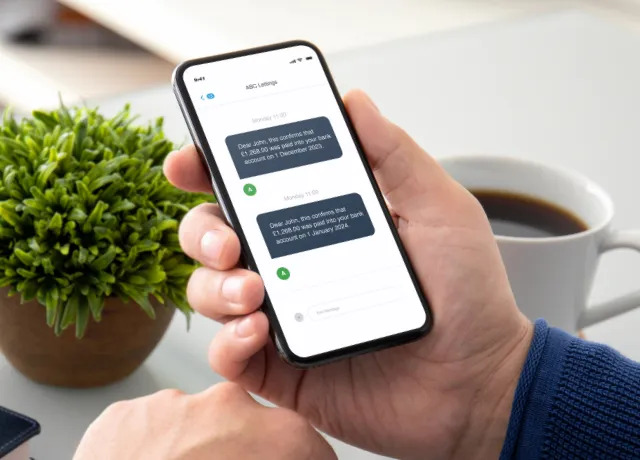

What separates PayProp from others on the market is its total autonomy and transparency. You wield full control over access permissions, ensuring that only authorised personnel can even come near your client account, let alone authorise any payments or related actions. This autonomy extends to your clients – tenants can see exactly how much they need to pay on the Tenant portal, while landlords can see how much they have been paid as and when they’ve been paid, and receive accurate statements automatically, saving you time and stress.

On top of that, every action taken on your client account is tracked and recorded in an undeletable audit log, leaving no room for dispute over who did what and when. This is invaluable if you have a landlord dispute or need evidence for a tenant eviction.

4. Unlock added value

When it comes to efficient lettings banking, PayProp packs even more perks: thanks to its seamless bank integration, you can pay your landlords and, crucially, your commission, on the same day you receive the rent. The real-time platform alerts you to missed payments right away and provides a range of effective tools to help you recover them.

Additionally, PayProp’s management reports help you benchmark your rents against local agencies, and the integrated maintenance ticketing system lets tenants report and track any issue online in a few clicks, making your life that much easier.

5. Think outside the box

With advanced automated PropTech, there’s no need to settle for an exhausting manual process or outsourcing. Book a demo to see how PayProp makes lettings banking less of a chore and more of a breeze.

Previous Articles

Faster payments make happier landlords...

Client money accounting made easy...

Help your landlords recover rent...

Share your views and you...