PayProp

The insider threat – 5 ways PayProp secures your letting agency

30 September 2022 7007 Views

According to the Association of Certified Fraud Examiners, organisations worldwide lose $4.7 trillion to fraud each year, with real estate suffering the highest median losses. Letting agencies are particularly at risk, as they handle large amounts of client money on a daily basis.

No business owner wants to put undue stress or responsibility on their employees to combat fraud in such pressured circumstances. But help is at hand.

For almost 20 years, PayProp has allowed responsible business owners to keep their employees safe from accusations of fraud and their clients’ money secure in a few simple steps. The best part? Our bank-integrated payment automation platform enables you to easily manage your risk by performing regular checks that take just 15 minutes, tops!

1. Defined and detailed user permissions

User permissions are your first and perhaps your most important way of protecting your employees, and PayProp gives you total control over what your team can see or do on the platform. You can adjust how many users it takes to performing important actions and what permissions they need.

Thanks to our granular level of permission settings you can, for example, enforce a separation of duties for certain actions or transactions, which means no one employee is responsible for completing a task single-handedly or is able to perform risky combinations of actions, such as creating new bank details for a landlord AND paying them, without someone else checking and authorising it.

2. Enhanced client money segregation

It’s already a legal requirement in the UK to hold client funds separately from agency money, but unlike other payment systems, PayProp takes this to the next level, protecting your agency from unwittingly paying money out of pooled client accounts to landlords when it has not actually received it in rent.

Every penny is accounted for – that is, actually received and reconciled to a specific property and purpose, so that it can only be paid out to the owners of that property, as commission or for whatever other purpose – and only that purpose. This stops colleagues from accidentally paying landlord A with landlord B’s rent money and helps to prevent bad actors from using social engineering to convince an employee to pay money into a fraudulent account.

3. Undeletable activity logs to protect your business

PayProp’s audit log protects staff by setting out who did what and when from the moment they log on – and stores it forever. Records can never be edited or deleted, so even actions taken by users who have been removed from the system will still be visible.

Regularly reviewing your audit log summary, whether weekly or monthly, will give you total visibility over legitimate user actions, making red flags even easier to catch and protecting your employees from false accusations.

4. Credit note control

Thanks to PayProp’s bank integration, there will very rarely be a need for an agent to create a credit note. If the money has been paid, it will show in your client account. That’s why PayProp allows you to limit who can create credit notes.

Any credit note will show in the PayProp audit log, so while you’re reviewing the month’s activities you can take a moment to look through the reasons entered on any credit notes that were recently created.

5. Safe tenancy deposits

Deposits are protected by law and covered by insurance. If you choose to hold deposits in your PayProp client account, our bank integration and reports give you complete oversight over every deposit and withdrawal. Tenancy, security or damage deposits should only be used to pay for any necessary repairs after a tenant has moved out of a property, and the balance must be paid out to the tenant, so keeping control of these insured amounts is key

PayProp’s Security Deposit reports make it easy to keep track of payments into and out of a tenant’s account. Checking these reports regularly throughout the tenancy will let you see if each tenant’s balance is correct, and ensure that all deposit requests and approvals are valid.

15 minutes a month buys you ongoing peace of mind

Given the ongoing cash flow exposure of letting agencies, business owners need to be hands-on to mitigate the risk. And it’s not just money that’s on the line – the damage to your reputation or your employee’s trust and potential client attrition can be irreversible. But thanks to PayProp, you can personally safeguard your agency and protect your team with very little effort.

PayProp’s intuitive security features allow you to be proactive in managing the risk of fraud and keep your business running smoothly. Just 15 minutes a month can spare you a lifetime of headaches. To get started, book a demo.

Previous Articles

Looking for a client account?...

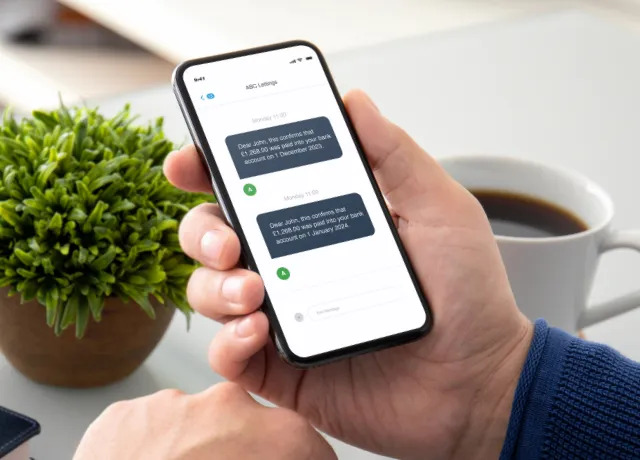

Faster payments make happier landlords...

Client money accounting made easy...

Help your landlords recover rent...